Page 47 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 47

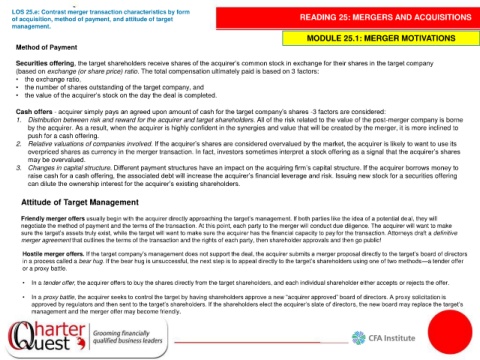

LOS 25.e: Contrast merger transaction characteristics by form

of acquisition, method of payment, and attitude of target READING 25: MERGERS AND ACQUISITIONS

management.

MODULE 25.1: MERGER MOTIVATIONS

Method of Payment

Securities offering, the target shareholders receive shares of the acquirer’s common stock in exchange for their shares in the target company

(based on exchange (or share price) ratio. The total compensation ultimately paid is based on 3 factors:

• the exchange ratio,

• the number of shares outstanding of the target company, and

• the value of the acquirer’s stock on the day the deal is completed.

Cash offers - acquirer simply pays an agreed upon amount of cash for the target company’s shares -3 factors are considered:

1. Distribution between risk and reward for the acquirer and target shareholders. All of the risk related to the value of the post-merger company is borne

by the acquirer. As a result, when the acquirer is highly confident in the synergies and value that will be created by the merger, it is more inclined to

push for a cash offering.

2. Relative valuations of companies involved. If the acquirer’s shares are considered overvalued by the market, the acquirer is likely to want to use its

overpriced shares as currency in the merger transaction. In fact, investors sometimes interpret a stock offering as a signal that the acquirer’s shares

may be overvalued.

3. Changes in capital structure. Different payment structures have an impact on the acquiring firm’s capital structure. If the acquirer borrows money to

raise cash for a cash offering, the associated debt will increase the acquirer’s financial leverage and risk. Issuing new stock for a securities offering

can dilute the ownership interest for the acquirer’s existing shareholders.

Attitude of Target Management

Friendly merger offers usually begin with the acquirer directly approaching the target’s management. If both parties like the idea of a potential deal, they will

negotiate the method of payment and the terms of the transaction. At this point, each party to the merger will conduct due diligence. The acquirer will want to make

sure the target’s assets truly exist, while the target will want to make sure the acquirer has the financial capacity to pay for the transaction. Attorneys draft a definitive

merger agreement that outlines the terms of the transaction and the rights of each party, then shareholder approvals and then go public!

Hostile merger offers. If the target company’s management does not support the deal, the acquirer submits a merger proposal directly to the target’s board of directors

in a process called a bear hug. If the bear hug is unsuccessful, the next step is to appeal directly to the target’s shareholders using one of two methods—a tender offer

or a proxy battle.

• In a tender offer, the acquirer offers to buy the shares directly from the target shareholders, and each individual shareholder either accepts or rejects the offer.

• In a proxy battle, the acquirer seeks to control the target by having shareholders approve a new “acquirer approved” board of directors. A proxy solicitation is

approved by regulators and then sent to the target’s shareholders. If the shareholders elect the acquirer’s slate of directors, the new board may replace the target’s

management and the merger offer may become friendly.