Page 43 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 43

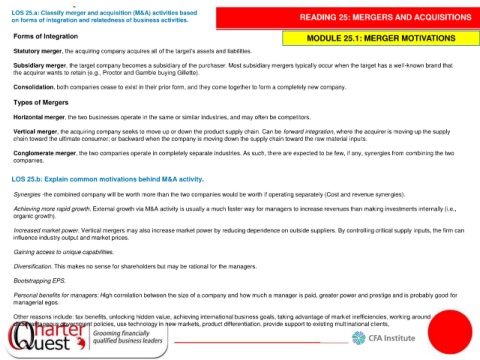

LOS 25.a: Classify merger and acquisition (M&A) activities based

on forms of integration and relatedness of business activities. READING 25: MERGERS AND ACQUISITIONS

Forms of Integration MODULE 25.1: MERGER MOTIVATIONS

Statutory merger, the acquiring company acquires all of the target’s assets and liabilities.

Subsidiary merger, the target company becomes a subsidiary of the purchaser. Most subsidiary mergers typically occur when the target has a well-known brand that

the acquirer wants to retain (e.g., Proctor and Gamble buying Gillette).

Consolidation, both companies cease to exist in their prior form, and they come together to form a completely new company.

Types of Mergers

Horizontal merger, the two businesses operate in the same or similar industries, and may often be competitors.

Vertical merger, the acquiring company seeks to move up or down the product supply chain. Can be forward integration, where the acquirer is moving up the supply

chain toward the ultimate consumer; or backward when the company is moving down the supply chain toward the raw material inputs.

Conglomerate merger, the two companies operate in completely separate industries. As such, there are expected to be few, if any, synergies from combining the two

companies.

LOS 25.b: Explain common motivations behind M&A activity.

Synergies -the combined company will be worth more than the two companies would be worth if operating separately (Cost and revenue synergies).

Achieving more rapid growth. External growth via M&A activity is usually a much faster way for managers to increase revenues than making investments internally (i.e.,

organic growth).

Increased market power. Vertical mergers may also increase market power by reducing dependence on outside suppliers. By controlling critical supply inputs, the firm can

influence industry output and market prices.

Gaining access to unique capabilities.

Diversification. This makes no sense for shareholders but may be rational for the managers.

Bootstrapping EPS.

Personal benefits for managers: High correlation between the size of a company and how much a manager is paid, greater power and prestige and is probably good for

managerial egos.

Other reasons include: tax benefits, unlocking hidden value, achieving international business goals, taking advantage of market inefficiencies, working around

disadvantageous government policies, use technology in new markets, product differentiation, provide support to existing multinational clients,