Page 44 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 44

LOS 25.c: Explain bootstrapping of earnings per share READING 25: MERGERS AND ACQUISITIONS

(EPS) and calculate a company’s post-merger EPS.

Bootstrapping is a way of packaging the combined earnings from MODULE 25.1: MERGER MOTIVATIONS

two companies after a merger so that the merger generates an

increase in the earnings per share of the acquirer, even when no real

economic gains have been achieved.

The “bootstrap effect” occurs when a high P/E firm acquires a low P/E firm in a stock transaction. Post-merger, the earnings of the combined firm are simply the sum of the

respective earnings prior to the merger. However, by purchasing the firm with a lower P/E, the acquiring firm is essentially exchanging higher-priced shares for lower-

priced shares. As a result, the number of shares outstanding for the acquiring firm increases, but at a ratio that is less than 1-for-1. When we compute the EPS for the

combined firm, the numerator (total earnings) is equal to the sum of the combined firms, but the denominator (total shares outstanding) is less than the sum of the

combined firms. The result is a higher reported EPS, even when the merger creates no additional synergistic value.

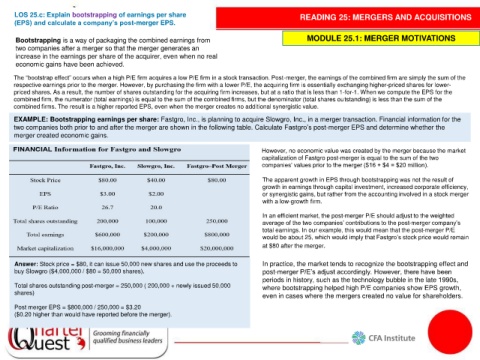

EXAMPLE: Bootstrapping earnings per share: Fastgro, Inc., is planning to acquire Slowgro, Inc., in a merger transaction. Financial information for the

two companies both prior to and after the merger are shown in the following table. Calculate Fastgro’s post-merger EPS and determine whether the

merger created economic gains.

However, no economic value was created by the merger because the market

capitalization of Fastgro post-merger is equal to the sum of the two

companies’ values prior to the merger ($16 + $4 = $20 million).

The apparent growth in EPS through bootstrapping was not the result of

growth in earnings through capital investment, increased corporate efficiency,

or synergistic gains, but rather from the accounting involved in a stock merger

with a low-growth firm.

In an efficient market, the post-merger P/E should adjust to the weighted

average of the two companies’ contributions to the post-merger company’s

total earnings. In our example, this would mean that the post-merger P/E

would be about 25, which would imply that Fastgro’s stock price would remain

at $80 after the merger.

Answer: Stock price = $80, it can issue 50,000 new shares and use the proceeds to In practice, the market tends to recognize the bootstrapping effect and

buy Slowgro ($4,000,000 / $80 = 50,000 shares). post-merger P/E’s adjust accordingly. However, there have been

periods in history, such as the technology bubble in the late 1990s,

Total shares outstanding post-merger = 250,000 ( 200,000 + newly issued 50,000 where bootstrapping helped high P/E companies show EPS growth,

shares)

even in cases where the mergers created no value for shareholders.

Post merger EPS = $800,000 / 250,000 = $3.20

($0.20 higher than would have reported before the merger).