Page 46 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 46

LOS 25.e: Contrast merger transaction characteristics by form

of acquisition, method of payment, and attitude of target READING 25: MERGERS AND ACQUISITIONS

management.

MODULE 25.2: DEFENSE MECHANISMS AND ANTITRUST

Forms of Acquisition

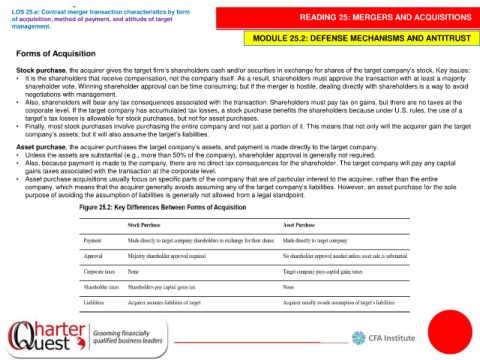

Stock purchase, the acquirer gives the target firm’s shareholders cash and/or securities in exchange for shares of the target company’s stock. Key issues:

• It is the shareholders that receive compensation, not the company itself. As a result, shareholders must approve the transaction with at least a majority

shareholder vote. Winning shareholder approval can be time consuming; but if the merger is hostile, dealing directly with shareholders is a way to avoid

negotiations with management.

• Also, shareholders will bear any tax consequences associated with the transaction. Shareholders must pay tax on gains, but there are no taxes at the

corporate level. If the target company has accumulated tax losses, a stock purchase benefits the shareholders because under U.S. rules, the use of a

target’s tax losses is allowable for stock purchases, but not for asset purchases.

• Finally, most stock purchases involve purchasing the entire company and not just a portion of it. This means that not only will the acquirer gain the target

company’s assets, but it will also assume the target’s liabilities.

Asset purchase, the acquirer purchases the target company’s assets, and payment is made directly to the target company.

• Unless the assets are substantial (e.g., more than 50% of the company), shareholder approval is generally not required.

• Also, because payment is made to the company, there are no direct tax consequences for the shareholder. The target company will pay any capital

gains taxes associated with the transaction at the corporate level.

• Asset purchase acquisitions usually focus on specific parts of the company that are of particular interest to the acquirer, rather than the entire

company, which means that the acquirer generally avoids assuming any of the target company’s liabilities. However, an asset purchase for the sole

purpose of avoiding the assumption of liabilities is generally not allowed from a legal standpoint.