Page 45 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 45

LOS 25.d: Explain, based on industry life cycles, the relation READING 25: MERGERS AND ACQUISITIONS

between merger motivations and types of mergers.

MODULE 25.1: MERGER MOTIVATIONS

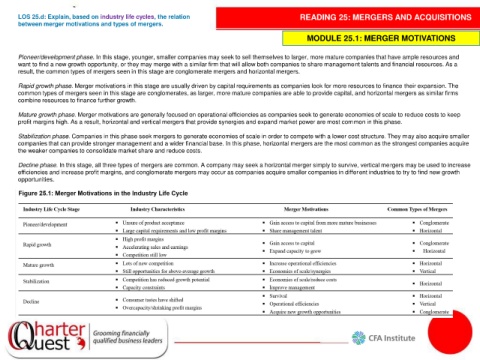

Pioneer/development phase. In this stage, younger, smaller companies may seek to sell themselves to larger, more mature companies that have ample resources and

want to find a new growth opportunity, or they may merge with a similar firm that will allow both companies to share management talents and financial resources. As a

result, the common types of mergers seen in this stage are conglomerate mergers and horizontal mergers.

Rapid growth phase. Merger motivations in this stage are usually driven by capital requirements as companies look for more resources to finance their expansion. The

common types of mergers seen in this stage are conglomerates, as larger, more mature companies are able to provide capital, and horizontal mergers as similar firms

combine resources to finance further growth.

Mature growth phase. Merger motivations are generally focused on operational efficiencies as companies seek to generate economies of scale to reduce costs to keep

profit margins high. As a result, horizontal and vertical mergers that provide synergies and expand market power are most common in this phase.

Stabilization phase. Companies in this phase seek mergers to generate economies of scale in order to compete with a lower cost structure. They may also acquire smaller

companies that can provide stronger management and a wider financial base. In this phase, horizontal mergers are the most common as the strongest companies acquire

the weaker companies to consolidate market share and reduce costs.

Decline phase. In this stage, all three types of mergers are common. A company may seek a horizontal merger simply to survive, vertical mergers may be used to increase

efficiencies and increase profit margins, and conglomerate mergers may occur as companies acquire smaller companies in different industries to try to find new growth

opportunities.