Page 50 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 50

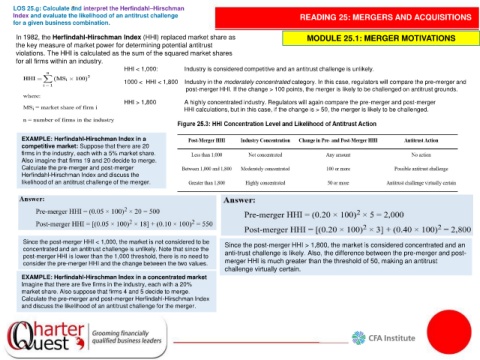

LOS 25.g: Calculate and interpret the Herfindahl–Hirschman

Index and evaluate the likelihood of an antitrust challenge READING 25: MERGERS AND ACQUISITIONS

for a given business combination.

In 1982, the Herfindahl-Hirschman Index (HHI) replaced market share as MODULE 25.1: MERGER MOTIVATIONS

the key measure of market power for determining potential antitrust

violations. The HHI is calculated as the sum of the squared market shares

for all firms within an industry.

HHI < 1,000: Industry is considered competitive and an antitrust challenge is unlikely.

1000 < HHI < 1,800 Industry in the moderately concentrated category. In this case, regulators will compare the pre-merger and

post-merger HHI. If the change > 100 points, the merger is likely to be challenged on antitrust grounds.

HHI > 1,800 A highly concentrated industry. Regulators will again compare the pre-merger and post-merger

HHI calculations, but in this case, if the change is > 50, the merger is likely to be challenged.

EXAMPLE: Herfindahl-Hirschman Index in a

competitive market: Suppose that there are 20

firms in the industry, each with a 5% market share.

Also imagine that firms 19 and 20 decide to merge.

Calculate the pre-merger and post-merger

Herfindahl-Hirschman Index and discuss the

likelihood of an antitrust challenge of the merger.

Since the post-merger HHI < 1,000, the market is not considered to be Since the post-merger HHI > 1,800, the market is considered concentrated and an

concentrated and an antitrust challenge is unlikely. Note that since the anti-trust challenge is likely. Also, the difference between the pre-merger and post-

post-merger HHI is lower than the 1,000 threshold, there is no need to

consider the pre-merger HHI and the change between the two values. merger HHI is much greater than the threshold of 50, making an antitrust

challenge virtually certain.

EXAMPLE: Herfindahl-Hirschman Index in a concentrated market

Imagine that there are five firms in the industry, each with a 20%

market share. Also suppose that firms 4 and 5 decide to merge.

Calculate the pre-merger and post-merger Herfindahl-Hirschman Index

and discuss the likelihood of an antitrust challenge for the merger.