Page 38 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 38

LOS 39.c: Describe and compare how interest rate,

currency, and equity swaps are priced and valued. READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

LOS 39.d: Calculate and interpret the no-arbitrage

value of interest rate, currency, and equity swaps. MODULE 39.8: CURRENCY SWAPS

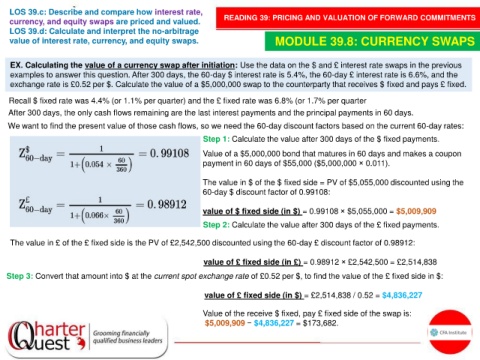

EX. Calculating the value of a currency swap after initiation: Use the data on the $ and £ interest rate swaps in the previous

examples to answer this question. After 300 days, the 60-day $ interest rate is 5.4%, the 60-day £ interest rate is 6.6%, and the

exchange rate is £0.52 per $. Calculate the value of a $5,000,000 swap to the counterparty that receives $ fixed and pays £ fixed.

Recall $ fixed rate was 4.4% (or 1.1% per quarter) and the £ fixed rate was 6.8% (or 1.7% per quarter

After 300 days, the only cash flows remaining are the last interest payments and the principal payments in 60 days.

We want to find the present value of those cash flows, so we need the 60-day discount factors based on the current 60-day rates:

Step 1: Calculate the value after 300 days of the $ fixed payments.

Value of a $5,000,000 bond that matures in 60 days and makes a coupon

payment in 60 days of $55,000 ($5,000,000 × 0.011).

The value in $ of the $ fixed side = PV of $5,055,000 discounted using the

60-day $ discount factor of 0.99108:

value of $ fixed side (in $) = 0.99108 × $5,055,000 = $5,009,909

Step 2: Calculate the value after 300 days of the £ fixed payments.

The value in £ of the £ fixed side is the PV of £2,542,500 discounted using the 60-day £ discount factor of 0.98912:

value of £ fixed side (in £) = 0.98912 × £2,542,500 = £2,514,838

Step 3: Convert that amount into $ at the current spot exchange rate of £0.52 per $, to find the value of the £ fixed side in $:

value of £ fixed side (in $) = £2,514,838 / 0.52 = $4,836,227

Value of the receive $ fixed, pay £ fixed side of the swap is:

$5,009,909 − $4,836,227 = $173,682.