Page 39 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 39

LOS 39.c: Describe and compare how interest rate,

currency, and equity swaps are priced and valued. READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

LOS 39.d: Calculate and interpret the no-arbitrage

value of interest rate, currency, and equity swaps. MODULE 39.9: EQUITY SWAPS

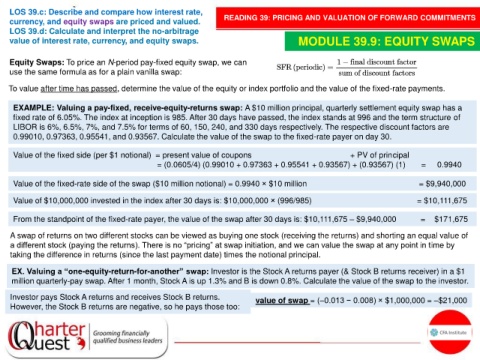

Equity Swaps: To price an N-period pay-fixed equity swap, we can

use the same formula as for a plain vanilla swap:

To value after time has passed, determine the value of the equity or index portfolio and the value of the fixed-rate payments.

EXAMPLE: Valuing a pay-fixed, receive-equity-returns swap: A $10 million principal, quarterly settlement equity swap has a

fixed rate of 6.05%. The index at inception is 985. After 30 days have passed, the index stands at 996 and the term structure of

LIBOR is 6%, 6.5%, 7%, and 7.5% for terms of 60, 150, 240, and 330 days respectively. The respective discount factors are

0.99010, 0.97363, 0.95541, and 0.93567. Calculate the value of the swap to the fixed-rate payer on day 30.

Value of the fixed side (per $1 notional) = present value of coupons + PV of principal

= (0.0605/4) (0.99010 + 0.97363 + 0.95541 + 0.93567) + (0.93567) (1) = 0.9940

Value of the fixed-rate side of the swap ($10 million notional) = 0.9940 × $10 million = $9,940,000

Value of $10,000,000 invested in the index after 30 days is: $10,000,000 × (996/985) = $10,111,675

From the standpoint of the fixed-rate payer, the value of the swap after 30 days is: $10,111,675 – $9,940,000 = $171,675

A swap of returns on two different stocks can be viewed as buying one stock (receiving the returns) and shorting an equal value of

a different stock (paying the returns). There is no “pricing” at swap initiation, and we can value the swap at any point in time by

taking the difference in returns (since the last payment date) times the notional principal.

EX. Valuing a “one-equity-return-for-another” swap: Investor is the Stock A returns payer (& Stock B returns receiver) in a $1

million quarterly-pay swap. After 1 month, Stock A is up 1.3% and B is down 0.8%. Calculate the value of the swap to the investor.

Investor pays Stock A returns and receives Stock B returns. value of swap = (–0.013 − 0.008) × $1,000,000 = –$21,000

However, the Stock B returns are negative, so he pays those too: