Page 37 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 37

LOS 39.c: Describe and compare how interest rate,

currency, and equity swaps are priced and valued. READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

LOS 39.d: Calculate and interpret the no-arbitrage

value of interest rate, currency, and equity swaps. MODULE 39.8: CURRENCY SWAPS

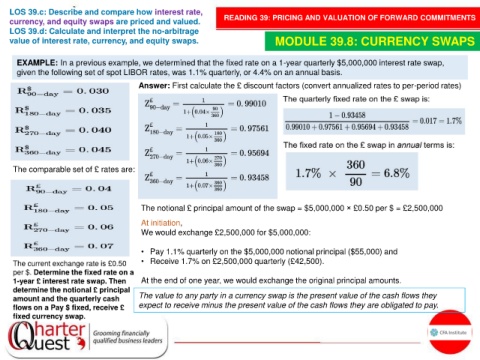

EXAMPLE: In a previous example, we determined that the fixed rate on a 1-year quarterly $5,000,000 interest rate swap,

given the following set of spot LIBOR rates, was 1.1% quarterly, or 4.4% on an annual basis.

Answer: First calculate the £ discount factors (convert annualized rates to per-period rates)

The comparable set of £ rates are:

The notional £ principal amount of the swap = $5,000,000 × £0.50 per $ = £2,500,000

At initiation,

We would exchange £2,500,000 for $5,000,000:

• Pay 1.1% quarterly on the $5,000,000 notional principal ($55,000) and

The current exchange rate is £0.50 • Receive 1.7% on £2,500,000 quarterly (£42,500).

per $. Determine the fixed rate on a

1-year £ interest rate swap. Then At the end of one year, we would exchange the original principal amounts.

determine the notional £ principal

amount and the quarterly cash The value to any party in a currency swap is the present value of the cash flows they

flows on a Pay $ fixed, receive £ expect to receive minus the present value of the cash flows they are obligated to pay.

fixed currency swap.