Page 32 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 32

LOS 39.a: Describe and compare how equity, interest

rate, fixed-income, and currency forward and futures READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

contracts are priced and valued.

LOS 39.b: Calculate and interpret the no-arbitrage

value of equity, interest rate, fixed-income, and MODULE 39.6: PRICING AND VALUATION OF CURRENCY CONTRACTS

currency forward and futures contracts.

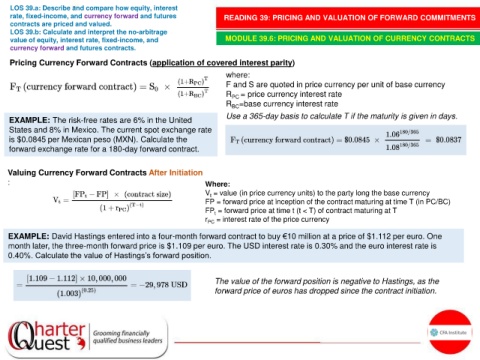

Pricing Currency Forward Contracts (application of covered interest parity)

where:

F and S are quoted in price currency per unit of base currency

R PC = price currency interest rate

R =base currency interest rate

BC

Use a 365-day basis to calculate T if the maturity is given in days.

EXAMPLE: The risk-free rates are 6% in the United

States and 8% in Mexico. The current spot exchange rate

is $0.0845 per Mexican peso (MXN). Calculate the

forward exchange rate for a 180-day forward contract.

Valuing Currency Forward Contracts After Initiation

: Where:

V = value (in price currency units) to the party long the base currency

t

FP = forward price at inception of the contract maturing at time T (in PC/BC)

FP = forward price at time t (t < T) of contract maturing at T

t

r PC = interest rate of the price currency

EXAMPLE: David Hastings entered into a four-month forward contract to buy €10 million at a price of $1.112 per euro. One

month later, the three-month forward price is $1.109 per euro. The USD interest rate is 0.30% and the euro interest rate is

0.40%. Calculate the value of Hastings’s forward position.

The value of the forward position is negative to Hastings, as the

forward price of euros has dropped since the contract initiation.