Page 28 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 28

LOS 39.a: Describe and compare how equity, interest rate,

fixed-income, and currency forward and futures contracts are READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

priced and valued.

LOS 39.b: Calculate and interpret the no-arbitrage value of

equity, interest rate, fixed-income, and currency forward and MODULE 39.4: PRICING FORWARD RATE AGREEMENTS

futures contracts.

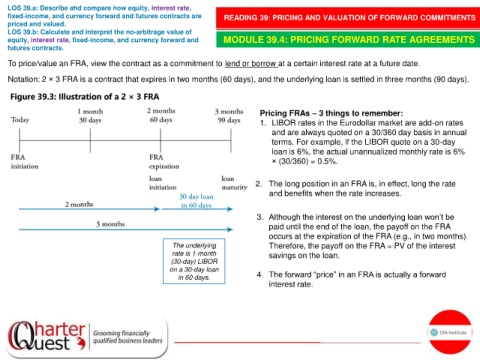

To price/value an FRA, view the contract as a commitment to lend or borrow at a certain interest rate at a future date.

Notation: 2 × 3 FRA is a contract that expires in two months (60 days), and the underlying loan is settled in three months (90 days).

Pricing FRAs – 3 things to remember:

1. LIBOR rates in the Eurodollar market are add-on rates

and are always quoted on a 30/360 day basis in annual

terms. For example, if the LIBOR quote on a 30-day

loan is 6%, the actual unannualized monthly rate is 6%

× (30/360) = 0.5%.

2. The long position in an FRA is, in effect, long the rate

and benefits when the rate increases.

3. Although the interest on the underlying loan won’t be

paid until the end of the loan, the payoff on the FRA

occurs at the expiration of the FRA (e.g., in two months).

The underlying Therefore, the payoff on the FRA = PV of the interest

rate is 1-month savings on the loan.

(30-day) LIBOR

on a 30-day loan

in 60 days. 4. The forward “price” in an FRA is actually a forward

interest rate.