Page 26 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 26

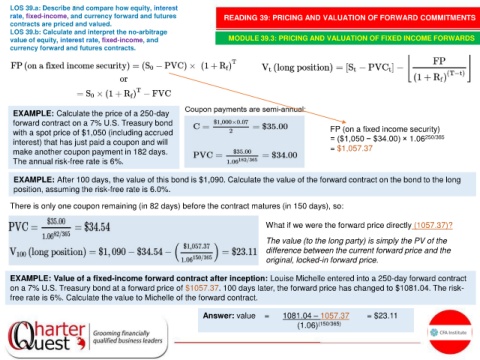

LOS 39.a: Describe and compare how equity, interest

rate, fixed-income, and currency forward and futures READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

contracts are priced and valued.

LOS 39.b: Calculate and interpret the no-arbitrage

value of equity, interest rate, fixed-income, and MODULE 39.3: PRICING AND VALUATION OF FIXED INCOME FORWARDS

currency forward and futures contracts.

EXAMPLE: Calculate the price of a 250-day

forward contract on a 7% U.S. Treasury bond

with a spot price of $1,050 (including accrued FP (on a fixed income security)

250/365

interest) that has just paid a coupon and will = ($1,050 − $34.00) × 1.06

make another coupon payment in 182 days. = $1,057.37

The annual risk-free rate is 6%.

EXAMPLE: After 100 days, the value of this bond is $1,090. Calculate the value of the forward contract on the bond to the long

position, assuming the risk-free rate is 6.0%.

There is only one coupon remaining (in 82 days) before the contract matures (in 150 days), so:

What if we were the forward price directly (1057.37)?

The value (to the long party) is simply the PV of the

difference between the current forward price and the

original, locked-in forward price.

EXAMPLE: Value of a fixed-income forward contract after inception: Louise Michelle entered into a 250-day forward contract

on a 7% U.S. Treasury bond at a forward price of $1057.37. 100 days later, the forward price has changed to $1081.04. The risk-

free rate is 6%. Calculate the value to Michelle of the forward contract.

Answer: value = 1081.04 – 1057.37 = $23.11

(1.06) (150/365)