Page 23 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 23

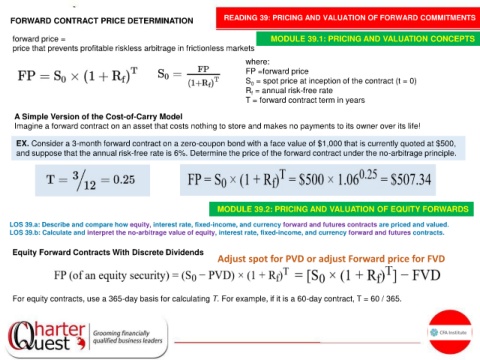

FORWARD CONTRACT PRICE DETERMINATION READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

forward price = MODULE 39.1: PRICING AND VALUATION CONCEPTS

price that prevents profitable riskless arbitrage in frictionless markets

where:

FP =forward price

S = spot price at inception of the contract (t = 0)

0

R = annual risk-free rate

f

T = forward contract term in years

A Simple Version of the Cost-of-Carry Model

Imagine a forward contract on an asset that costs nothing to store and makes no payments to its owner over its life!

EX. Consider a 3-month forward contract on a zero-coupon bond with a face value of $1,000 that is currently quoted at $500,

and suppose that the annual risk-free rate is 6%. Determine the price of the forward contract under the no-arbitrage principle.

MODULE 39.2: PRICING AND VALUATION OF EQUITY FORWARDS

LOS 39.a: Describe and compare how equity, interest rate, fixed-income, and currency forward and futures contracts are priced and valued.

LOS 39.b: Calculate and interpret the no-arbitrage value of equity, interest rate, fixed-income, and currency forward and futures contracts.

Equity Forward Contracts With Discrete Dividends

Adjust spot for PVD or adjust Forward price for FVD

For equity contracts, use a 365-day basis for calculating T. For example, if it is a 60-day contract, T = 60 / 365.