Page 18 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 18

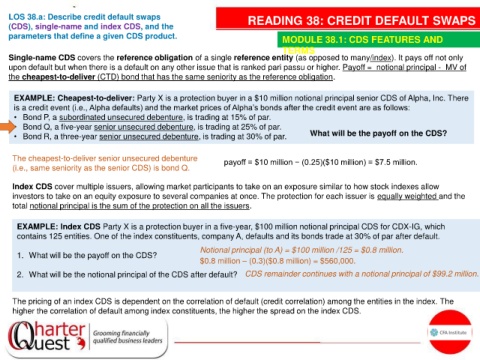

LOS 38.a: Describe credit default swaps READING 38: CREDIT DEFAULT SWAPS

(CDS), single-name and index CDS, and the

parameters that define a given CDS product. MODULE 38.1: CDS FEATURES AND

TERMS

Single-name CDS covers the reference obligation of a single reference entity (as opposed to many/index). It pays off not only

upon default but when there is a default on any other issue that is ranked pari passu or higher. Payoff = notional principal - MV of

the cheapest-to-deliver (CTD) bond that has the same seniority as the reference obligation.

EXAMPLE: Cheapest-to-deliver: Party X is a protection buyer in a $10 million notional principal senior CDS of Alpha, Inc. There

is a credit event (i.e., Alpha defaults) and the market prices of Alpha’s bonds after the credit event are as follows:

• Bond P, a subordinated unsecured debenture, is trading at 15% of par.

• Bond Q, a five-year senior unsecured debenture, is trading at 25% of par.

• Bond R, a three-year senior unsecured debenture, is trading at 30% of par. What will be the payoff on the CDS?

The cheapest-to-deliver senior unsecured debenture payoff = $10 million − (0.25)($10 million) = $7.5 million.

(i.e., same seniority as the senior CDS) is bond Q.

Index CDS cover multiple issuers, allowing market participants to take on an exposure similar to how stock indexes allow

investors to take on an equity exposure to several companies at once. The protection for each issuer is equally weighted and the

total notional principal is the sum of the protection on all the issuers.

EXAMPLE: Index CDS Party X is a protection buyer in a five-year, $100 million notional principal CDS for CDX-IG, which

contains 125 entities. One of the index constituents, company A, defaults and its bonds trade at 30% of par after default.

Notional principal (to A) = $100 million /125 = $0.8 million.

1. What will be the payoff on the CDS?

$0.8 million – (0.3)($0.8 million) = $560,000.

2. What will be the notional principal of the CDS after default? CDS remainder continues with a notional principal of $99.2 million.

The pricing of an index CDS is dependent on the correlation of default (credit correlation) among the entities in the index. The

higher the correlation of default among index constituents, the higher the spread on the index CDS.