Page 15 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 15

LOS 37.g: Explain the determinants of the term

structure of credit spreads and interpret a term READING 37: CREDIT ANALYSIS MODELS

structure of credit spreads.

MODULE 37.6: CREDIT SPREAD

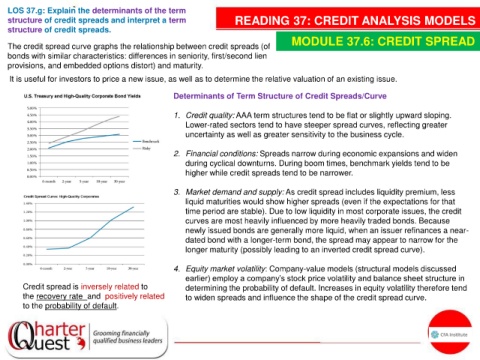

The credit spread curve graphs the relationship between credit spreads (of

bonds with similar characteristics: differences in seniority, first/second lien

provisions, and embedded options distort) and maturity.

It is useful for investors to price a new issue, as well as to determine the relative valuation of an existing issue.

Determinants of Term Structure of Credit Spreads/Curve

1. Credit quality: AAA term structures tend to be flat or slightly upward sloping.

Lower-rated sectors tend to have steeper spread curves, reflecting greater

uncertainty as well as greater sensitivity to the business cycle.

2. Financial conditions: Spreads narrow during economic expansions and widen

during cyclical downturns. During boom times, benchmark yields tend to be

higher while credit spreads tend to be narrower.

3. Market demand and supply: As credit spread includes liquidity premium, less

liquid maturities would show higher spreads (even if the expectations for that

time period are stable). Due to low liquidity in most corporate issues, the credit

curves are most heavily influenced by more heavily traded bonds. Because

newly issued bonds are generally more liquid, when an issuer refinances a near-

dated bond with a longer-term bond, the spread may appear to narrow for the

longer maturity (possibly leading to an inverted credit spread curve).

4. Equity market volatility: Company-value models (structural models discussed

earlier) employ a company’s stock price volatility and balance sheet structure in

Credit spread is inversely related to determining the probability of default. Increases in equity volatility therefore tend

the recovery rate and positively related to widen spreads and influence the shape of the credit spread curve.

to the probability of default.