Page 10 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 10

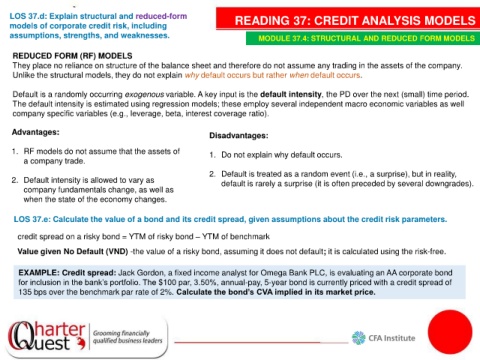

LOS 37.d: Explain structural and reduced-form READING 37: CREDIT ANALYSIS MODELS

models of corporate credit risk, including

assumptions, strengths, and weaknesses. MODULE 37.4: STRUCTURAL AND REDUCED FORM MODELS

REDUCED FORM (RF) MODELS

They place no reliance on structure of the balance sheet and therefore do not assume any trading in the assets of the company.

Unlike the structural models, they do not explain why default occurs but rather when default occurs.

Default is a randomly occurring exogenous variable. A key input is the default intensity, the PD over the next (small) time period.

The default intensity is estimated using regression models; these employ several independent macro economic variables as well

company specific variables (e.g., leverage, beta, interest coverage ratio).

Advantages: Disadvantages:

1. RF models do not assume that the assets of 1. Do not explain why default occurs.

a company trade.

2. Default is treated as a random event (i.e., a surprise), but in reality,

2. Default intensity is allowed to vary as default is rarely a surprise (it is often preceded by several downgrades).

company fundamentals change, as well as

when the state of the economy changes.

LOS 37.e: Calculate the value of a bond and its credit spread, given assumptions about the credit risk parameters.

credit spread on a risky bond = YTM of risky bond – YTM of benchmark

Value given No Default (VND) -the value of a risky bond, assuming it does not default; it is calculated using the risk-free.

EXAMPLE: Credit spread: Jack Gordon, a fixed income analyst for Omega Bank PLC, is evaluating an AA corporate bond

for inclusion in the bank’s portfolio. The $100 par, 3.50%, annual-pay, 5-year bond is currently priced with a credit spread of

135 bps over the benchmark par rate of 2%. Calculate the bond’s CVA implied in its market price.