Page 6 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 6

LOS 37.a: Explain expected exposure, the loss READING 37: CREDIT ANALYSIS MODELS

given default, the probability of default, and the

credit valuation adjustment.

MODULE 37.2: ANALYSIS OF CREDIT RISK

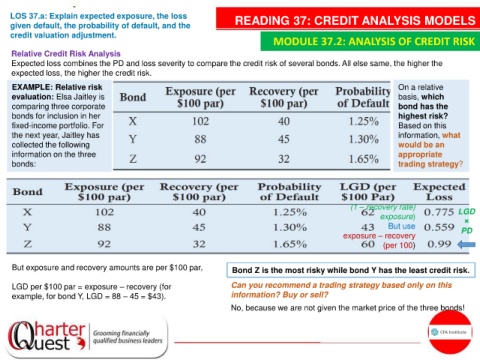

Relative Credit Risk Analysis

Expected loss combines the PD and loss severity to compare the credit risk of several bonds. All else same, the higher the

expected loss, the higher the credit risk.

EXAMPLE: Relative risk On a relative

evaluation: Elsa Jaitley is basis, which

comparing three corporate bond has the

bonds for inclusion in her highest risk?

fixed-income portfolio. For Based on this

the next year, Jaitley has information, what

collected the following would be an

information on the three appropriate

bonds: trading strategy?

(1 – recovery rate) LGD

exposure) ×

But use PD

exposure – recovery

(per 100)

But exposure and recovery amounts are per $100 par, Bond Z is the most risky while bond Y has the least credit risk.

LGD per $100 par = exposure – recovery (for Can you recommend a trading strategy based only on this

example, for bond Y, LGD = 88 – 45 = $43). information? Buy or sell?

No, because we are not given the market price of the three bonds!