Page 3 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 3

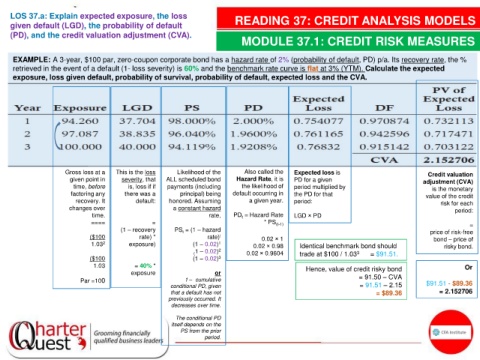

LOS 37.a: Explain expected exposure, the loss READING 37: CREDIT ANALYSIS MODELS

given default (LGD), the probability of default

(PD), and the credit valuation adjustment (CVA).

MODULE 37.1: CREDIT RISK MEASURES

EXAMPLE: A 3-year, $100 par, zero-coupon corporate bond has a hazard rate of 2% (probability of default, PD) p/a. Its recovery rate, the %

retrieved in the event of a default (1- loss severity) is 60% and the benchmark rate curve is flat at 3% (YTM). Calculate the expected

exposure, loss given default, probability of survival, probability of default, expected loss and the CVA.

Gross loss at a This is the loss Likelihood of the Also called the Expected loss is Credit valuation

given point in severity, that ALL scheduled bond Hazard Rate, it is PD for a given adjustment (CVA)

time, before is, loss if if payments (including the likelihood of period multiplied by is the monetary

factoring any there was a principal) being default occurring in the PD for that value of the credit

recovery. It default: honored. Assuming a given year. period: risk for each

changes over a constant hazard period:

time. rate, PD = Hazard Rate LGD × PD

t

==== = * PS (t-1) =

(1 – recovery PS = (1 – hazard price of risk-free

t

($100 rate) * rate) t 0.02 × 1 bond – price of

1.03 2 exposure) (1 – 0.02) 1 0.02 × 0.98 Identical benchmark bond should risky bond.

1 – 0.02) 2

( 0.02 × 0.9604 trade at $100 / 1.03 3 = $91.51.

($100 (1 – 0.02) 3

1.03 = 40% * Hence, value of credit risky bond Or

exposure or

Par =100 1 – cumulative = 91.50 – CVA $91.51 - $89.36

conditional PD, given = 91.51 – 2.15

that a default has not = $89.36 = 2.152706

previously occurred. It

decreases over time.

The conditional PD

itself depends on the

PS from the prior

period.