Page 4 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 4

LOS 37.a: Explain expected exposure, the loss READING 37: CREDIT ANALYSIS MODELS

given default, the probability of default, and the

credit valuation adjustment.

MODULE 37.1: CREDIT RISK MEASURES

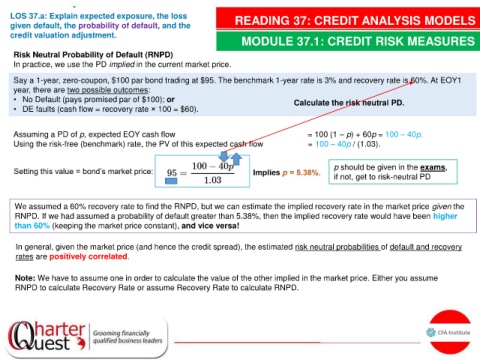

Risk Neutral Probability of Default (RNPD)

In practice, we use the PD implied in the current market price.

Say a 1-year, zero-coupon, $100 par bond trading at $95. The benchmark 1-year rate is 3% and recovery rate is 60%. At EOY1

year, there are two possible outcomes:

• No Default (pays promised par of $100); or Calculate the risk neutral PD.

• DE faults (cash flow = recovery rate × 100 = $60).

Assuming a PD of p, expected EOY cash flow = 100 (1 – p) + 60p = 100 – 40p.

Using the risk-free (benchmark) rate, the PV of this expected cash flow = 100 – 40p / (1.03).

p should be given in the exams,

if not, get to risk-neutral PD

We assumed a 60% recovery rate to find the RNPD, but we can estimate the implied recovery rate in the market price given the

RNPD. If we had assumed a probability of default greater than 5.38%, then the implied recovery rate would have been higher

than 60% (keeping the market price constant), and vice versa!

In general, given the market price (and hence the credit spread), the estimated risk neutral probabilities of default and recovery

rates are positively correlated.

Note: We have to assume one in order to calculate the value of the other implied in the market price. Either you assume

RNPD to calculate Recovery Rate or assume Recovery Rate to calculate RNPD.