Page 7 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 7

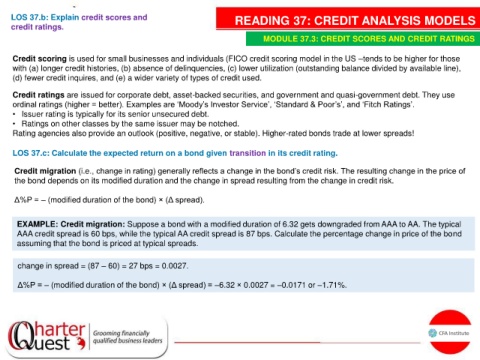

LOS 37.b: Explain credit scores and READING 37: CREDIT ANALYSIS MODELS

credit ratings.

MODULE 37.3: CREDIT SCORES AND CREDIT RATINGS

Credit scoring is used for small businesses and individuals (FICO credit scoring model in the US –tends to be higher for those

with (a) longer credit histories, (b) absence of delinquencies, (c) lower utilization (outstanding balance divided by available line),

(d) fewer credit inquires, and (e) a wider variety of types of credit used.

Credit ratings are issued for corporate debt, asset-backed securities, and government and quasi-government debt. They use

ordinal ratings (higher = better). Examples are ‘Moody’s Investor Service’, ‘Standard & Poor’s’, and ‘Fitch Ratings’.

• Issuer rating is typically for its senior unsecured debt.

• Ratings on other classes by the same issuer may be notched.

Rating agencies also provide an outlook (positive, negative, or stable). Higher-rated bonds trade at lower spreads!

LOS 37.c: Calculate the expected return on a bond given transition in its credit rating.

Credit migration (i.e., change in rating) generally reflects a change in the bond’s credit risk. The resulting change in the price of

the bond depends on its modified duration and the change in spread resulting from the change in credit risk.

Δ%P = – (modified duration of the bond) × (Δ spread).

EXAMPLE: Credit migration: Suppose a bond with a modified duration of 6.32 gets downgraded from AAA to AA. The typical

AAA credit spread is 60 bps, while the typical AA credit spread is 87 bps. Calculate the percentage change in price of the bond

assuming that the bond is priced at typical spreads.

change in spread = (87 – 60) = 27 bps = 0.0027.

Δ%P = – (modified duration of the bond) × (Δ spread) = –6.32 × 0.0027 = –0.0171 or –1.71%.