Page 12 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 12

LOS 37.e: Calculate the value of a bond READING 37: CREDIT ANALYSIS MODELS

and its credit spread, given assumptions

about the credit risk parameters.

MODULE 37.5: CREDIT SPREAD ANALYSIS

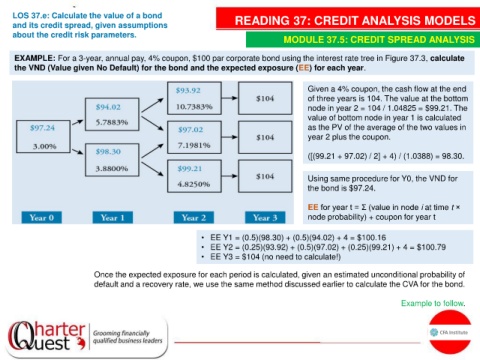

EXAMPLE: For a 3-year, annual pay, 4% coupon, $100 par corporate bond using the interest rate tree in Figure 37.3, calculate

the VND (Value given No Default) for the bond and the expected exposure (EE) for each year.

Given a 4% coupon, the cash flow at the end

of three years is 104. The value at the bottom

node in year 2 = 104 / 1.04825 = $99.21. The

value of bottom node in year 1 is calculated

as the PV of the average of the two values in

year 2 plus the coupon.

([(99.21 + 97.02) / 2] + 4) / (1.0388) = 98.30.

Using same procedure for Y0, the VND for

the bond is $97.24.

EE for year t = Σ (value in node i at time t ×

node probability) + coupon for year t

• EE Y1 = (0.5)(98.30) + (0.5)(94.02) + 4 = $100.16

• EE Y2 = (0.25)(93.92) + (0.5)(97.02) + (0.25)(99.21) + 4 = $100.79

• EE Y3 = $104 (no need to calculate!)

Once the expected exposure for each period is calculated, given an estimated unconditional probability of

default and a recovery rate, we use the same method discussed earlier to calculate the CVA for the bond.

Example to follow.