Page 16 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 16

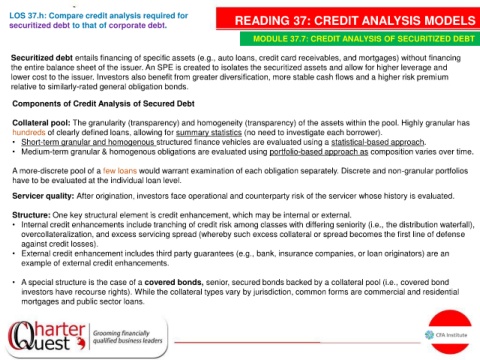

LOS 37.h: Compare credit analysis required for READING 37: CREDIT ANALYSIS MODELS

securitized debt to that of corporate debt.

MODULE 37.7: CREDIT ANALYSIS OF SECURITIZED DEBT

Securitized debt entails financing of specific assets (e.g., auto loans, credit card receivables, and mortgages) without financing

the entire balance sheet of the issuer. An SPE is created to isolates the securitized assets and allow for higher leverage and

lower cost to the issuer. Investors also benefit from greater diversification, more stable cash flows and a higher risk premium

relative to similarly-rated general obligation bonds.

Components of Credit Analysis of Secured Debt

Collateral pool: The granularity (transparency) and homogeneity (transparency) of the assets within the pool. Highly granular has

hundreds of clearly defined loans, allowing for summary statistics (no need to investigate each borrower).

• Short-term granular and homogenous structured finance vehicles are evaluated using a statistical-based approach.

• Medium-term granular & homogenous obligations are evaluated using portfolio-based approach as composition varies over time.

A more-discrete pool of a few loans would warrant examination of each obligation separately. Discrete and non-granular portfolios

have to be evaluated at the individual loan level.

Servicer quality: After origination, investors face operational and counterparty risk of the servicer whose history is evaluated.

Structure: One key structural element is credit enhancement, which may be internal or external.

• Internal credit enhancements include tranching of credit risk among classes with differing seniority (i.e., the distribution waterfall),

overcollateralization, and excess servicing spread (whereby such excess collateral or spread becomes the first line of defense

against credit losses).

• External credit enhancement includes third party guarantees (e.g., bank, insurance companies, or loan originators) are an

example of external credit enhancements.

• A special structure is the case of a covered bonds, senior, secured bonds backed by a collateral pool (i.e., covered bond

investors have recourse rights). While the collateral types vary by jurisdiction, common forms are commercial and residential

mortgages and public sector loans.