Page 19 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 19

LOS 38.b: Describe credit events and

settlement protocols with respect to CDS. READING 38: CREDIT DEFAULT SWAPS

MODULE 38.1: CDS FEATURES AND

A default is the occurrence of a credit event –common types include: TERMS

• Bankruptcy (protection filing): Allows you to work with creditors under court supervision to avoid full liquidation.

• Failure to pay: Occurs when you miss a scheduled coupon or principal payment without filing for formal bankruptcy.

• Restructuring: Occurs when you force creditors to accept terms that are different than those specified in the original issue.

Restructuring is less common in the United States as issuers prefer to go the bankruptcy protection route.

A 15-member group of the ISDA called the Determinations Committee (DC) declares when a credit event has occurred. A

supermajority vote (at least 12 members) is required for a credit event to be declared. When there is a credit event, the swap will

be settled in cash or by physical delivery.

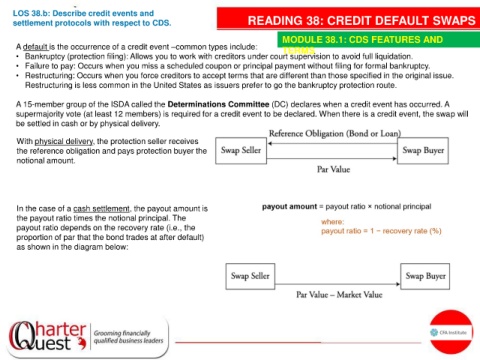

With physical delivery, the protection seller receives

the reference obligation and pays protection buyer the

notional amount.

In the case of a cash settlement, the payout amount is

the payout ratio times the notional principal. The

payout ratio depends on the recovery rate (i.e., the

proportion of par that the bond trades at after default)

as shown in the diagram below: