Page 17 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 17

LOS 38.a: Describe credit default swaps READING 38: CREDIT DEFAULT SWAPS

(CDS), single-name and index CDS, and the

parameters that define a given CDS product. MODULE 38.1: CDS FEATURES AND

TERMS

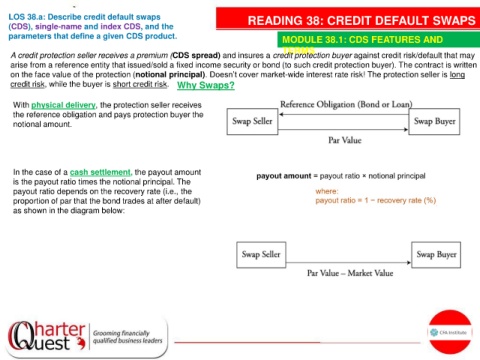

A credit protection seller receives a premium (CDS spread) and insures a credit protection buyer against credit risk/default that may

arise from a reference entity that issued/sold a fixed income security or bond (to such credit protection buyer). The contract is written

on the face value of the protection (notional principal). Doesn’t cover market-wide interest rate risk! The protection seller is long

credit risk, while the buyer is short credit risk. Why Swaps?

With physical delivery, the protection seller receives

the reference obligation and pays protection buyer the

notional amount.

In the case of a cash settlement, the payout amount

is the payout ratio times the notional principal. The

payout ratio depends on the recovery rate (i.e., the

proportion of par that the bond trades at after default)

as shown in the diagram below: