Page 13 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 13

LOS 37.f: Interpret changes in a credit spread. READING 37: CREDIT ANALYSIS MODELS

A benchmark yield = Rf + expected inflation +

risk-premium for uncertainty in future inflation. MODULE 37.6: CREDIT SPREAD

Credit spreads include compensation for default, liquidity, and taxation risks relative to the benchmark.

Adjustment to the price for all these risk factors together is known as the XVA but here, we focus only on the default risk component

(i.e., CVA) as it is the most important and most-commonly-used in practice. Credit spreads change as investor perceptions about the

future probability of default and recovery rates change. These perceptions depend on expectations about the state of the economy.

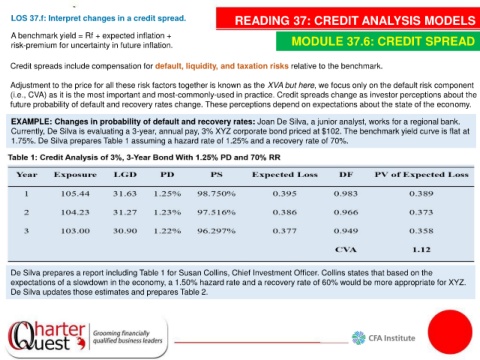

EXAMPLE: Changes in probability of default and recovery rates: Joan De Silva, a junior analyst, works for a regional bank.

Currently, De Silva is evaluating a 3-year, annual pay, 3% XYZ corporate bond priced at $102. The benchmark yield curve is flat at

1.75%. De Silva prepares Table 1 assuming a hazard rate of 1.25% and a recovery rate of 70%.

De Silva prepares a report including Table 1 for Susan Collins, Chief Investment Officer. Collins states that based on the

expectations of a slowdown in the economy, a 1.50% hazard rate and a recovery rate of 60% would be more appropriate for XYZ.

De Silva updates those estimates and prepares Table 2.