Page 14 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 14

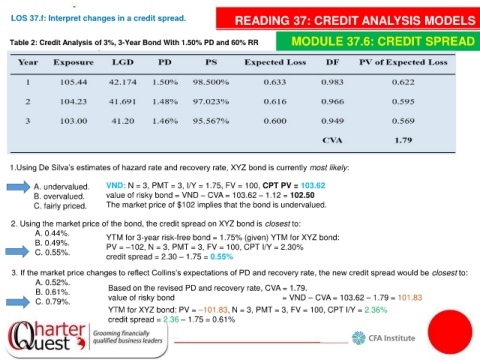

LOS 37.f: Interpret changes in a credit spread. READING 37: CREDIT ANALYSIS MODELS

Table 2: Credit Analysis of 3%, 3-Year Bond With 1.50% PD and 60% RR MODULE 37.6: CREDIT SPREAD

1.Using De Silva’s estimates of hazard rate and recovery rate, XYZ bond is currently most likely:

A. undervalued. VND: N = 3, PMT = 3, I/Y = 1.75, FV = 100, CPT PV = 103.62

B. overvalued. value of risky bond = VND – CVA = 103.62 – 1.12 = 102.50

C. fairly priced. The market price of $102 implies that the bond is undervalued.

2. Using the market price of the bond, the credit spread on XYZ bond is closest to:

A. 0.44%. YTM for 3-year risk-free bond = 1.75% (given) YTM for XYZ bond:

B. 0.49%. PV = –102, N = 3, PMT = 3, FV = 100, CPT I/Y = 2.30%

C. 0.55%.

credit spread = 2.30 – 1.75 = 0.55%

3. If the market price changes to reflect Collins’s expectations of PD and recovery rate, the new credit spread would be closest to:

A. 0.52%.

B. 0.61%. Based on the revised PD and recovery rate, CVA = 1.79.

C. 0.79%. value of risky bond = VND – CVA = 103.62 – 1.79 = 101.83

YTM for XYZ bond: PV = –101.83, N = 3, PMT = 3, FV = 100, CPT I/Y = 2.36%

credit spread = 2.36 – 1.75 = 0.61%