Page 11 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 11

LOS 37.e: Calculate the value of a bond READING 37: CREDIT ANALYSIS MODELS

and its credit spread, given assumptions

about the credit risk parameters.

MODULE 37.5: CREDIT SPREAD ANALYSIS

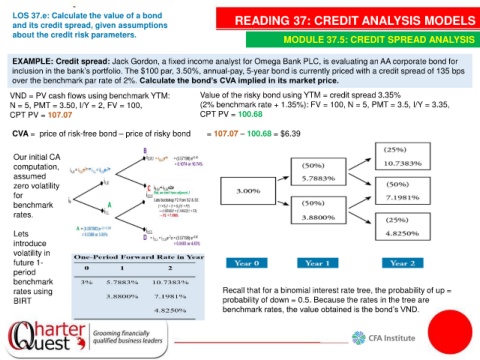

EXAMPLE: Credit spread: Jack Gordon, a fixed income analyst for Omega Bank PLC, is evaluating an AA corporate bond for

inclusion in the bank’s portfolio. The $100 par, 3.50%, annual-pay, 5-year bond is currently priced with a credit spread of 135 bps

over the benchmark par rate of 2%. Calculate the bond’s CVA implied in its market price.

VND = PV cash flows using benchmark YTM: Value of the risky bond using YTM = credit spread 3.35%

N = 5, PMT = 3.50, I/Y = 2, FV = 100, (2% benchmark rate + 1.35%): FV = 100, N = 5, PMT = 3.5, I/Y = 3.35,

CPT PV = 107.07 CPT PV = 100.68

CVA = price of risk-free bond – price of risky bond = 107.07 – 100.68 = $6.39

Our initial CA

computation,

assumed

zero volatility

for

benchmark

rates.

Lets

introduce

volatility in

future 1-

period

benchmark

rates using Recall that for a binomial interest rate tree, the probability of up =

BIRT probability of down = 0.5. Because the rates in the tree are

benchmark rates, the value obtained is the bond’s VND.