Page 8 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 8

LOS 37.d: Explain structural and reduced-form READING 37: CREDIT ANALYSIS MODELS

models of corporate credit risk, including

assumptions, strengths, and weaknesses. MODULE 37.4: STRUCTURAL AND REDUCED FORM MODELS

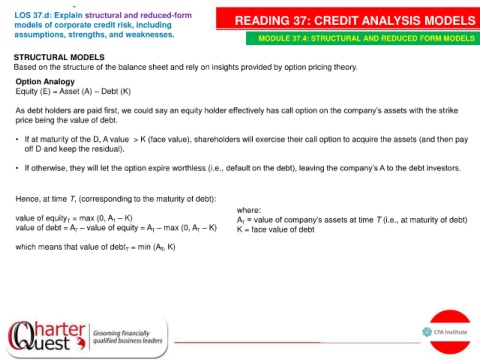

STRUCTURAL MODELS

Based on the structure of the balance sheet and rely on insights provided by option pricing theory.

Option Analogy

Equity (E) = Asset (A) – Debt (K)

As debt holders are paid first, we could say an equity holder effectively has call option on the company’s assets with the strike

price being the value of debt.

• If at maturity of the D, A value > K (face value), shareholders will exercise their call option to acquire the assets (and then pay

off D and keep the residual).

• If otherwise, they will let the option expire worthless (i.e., default on the debt), leaving the company’s A to the debt investors.

Hence, at time T, (corresponding to the maturity of debt):

where:

value of equity = max (0, A – K) A = value of company’s assets at time T (i.e., at maturity of debt)

T

T

T

value of debt = A – value of equity = A – max (0, A – K) K = face value of debt

T

T

T

which means that value of debt = min (A , K)

T

T