Page 5 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 5

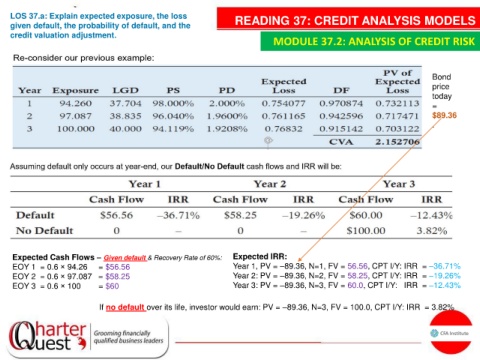

LOS 37.a: Explain expected exposure, the loss READING 37: CREDIT ANALYSIS MODELS

given default, the probability of default, and the

credit valuation adjustment.

MODULE 37.2: ANALYSIS OF CREDIT RISK

Bond

price

today

=

$89.36

.

Expected Cash Flows – Given default & Recovery Rate of 60%: Expected IRR:

EOY 1 = 0.6 × 94.26 = $56.56 Year 1, PV = –89.36, N=1, FV = 56.56, CPT I/Y: IRR = –36.71%

EOY 2 = 0.6 × 97.087 = $58.25 Year 2: PV = –89.36, N=2, FV = 58.25, CPT I/Y: IRR = –19.26%

Year 3: PV = –89.36, N=3, FV = 60.0, CPT I/Y: IRR = –12.43%

EOY 3 = 0.6 × 100 = $60

If no default over its life, investor would earn: PV = –89.36, N=3, FV = 100.0, CPT I/Y: IRR = 3.82%