Page 20 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 20

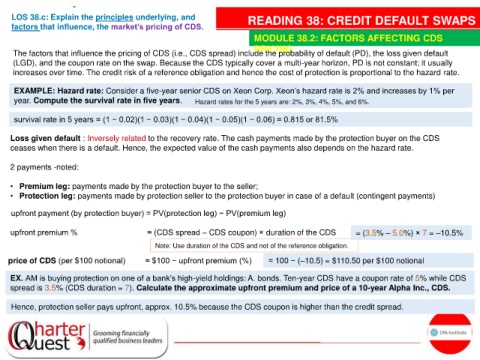

LOS 38.c: Explain the principles underlying, and READING 38: CREDIT DEFAULT SWAPS

factors that influence, the market’s pricing of CDS.

MODULE 38.2: FACTORS AFFECTING CDS

PRICING

The factors that influence the pricing of CDS (i.e., CDS spread) include the probability of default (PD), the loss given default

(LGD), and the coupon rate on the swap. Because the CDS typically cover a multi-year horizon, PD is not constant; it usually

increases over time. The credit risk of a reference obligation and hence the cost of protection is proportional to the hazard rate.

EXAMPLE: Hazard rate: Consider a five-year senior CDS on Xeon Corp. Xeon’s hazard rate is 2% and increases by 1% per

year. Compute the survival rate in five years. Hazard rates for the 5 years are: 2%, 3%, 4%, 5%, and 6%.

survival rate in 5 years = (1 − 0.02)(1 − 0.03)(1 − 0.04)(1 − 0.05)(1 − 0.06) = 0.815 or 81.5%

Loss given default : Inversely related to the recovery rate. The cash payments made by the protection buyer on the CDS

ceases when there is a default. Hence, the expected value of the cash payments also depends on the hazard rate.

2 payments -noted:

• Premium leg: payments made by the protection buyer to the seller;

• Protection leg: payments made by protection seller to the protection buyer in case of a default (contingent payments)

upfront payment (by protection buyer) = PV(protection leg) − PV(premium leg)

upfront premium % ≈ (CDS spread – CDS coupon) × duration of the CDS = (3.5% – 5.0%) × 7 = –10.5%

Note: Use duration of the CDS and not of the reference obligation.

price of CDS (per $100 notional) ≈ $100 − upfront premium (%) = 100 − (–10.5) = $110.50 per $100 notional

EX. AM is buying protection on one of a bank’s high-yield holdings: A. bonds. Ten-year CDS have a coupon rate of 5% while CDS

spread is 3.5% (CDS duration = 7). Calculate the approximate upfront premium and price of a 10-year Alpha Inc., CDS.

Hence, protection seller pays upfront, approx. 10.5% because the CDS coupon is higher than the credit spread.