Page 25 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 25

LOS 39.a: Describe and compare how equity, interest rate, fixed-

income, and currency forward and futures contracts are priced READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

and valued.

LOS 39.b: Calculate and interpret the no-arbitrage value of

equity, interest rate, fixed-income, and currency forward and MODULE 39.2: PRICING AND VALUATION OF EQUITY FORWARDS

futures contracts.

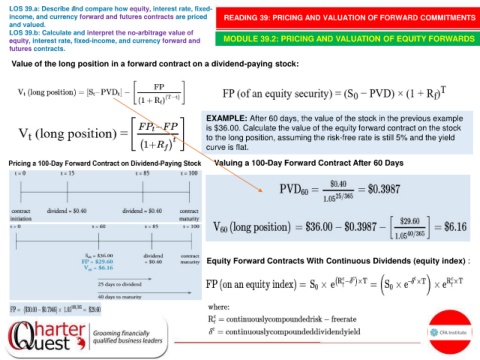

Value of the long position in a forward contract on a dividend-paying stock:

EXAMPLE: After 60 days, the value of the stock in the previous example

is $36.00. Calculate the value of the equity forward contract on the stock

to the long position, assuming the risk-free rate is still 5% and the yield

curve is flat.

Valuing a 100-Day Forward Contract After 60 Days

Equity Forward Contracts With Continuous Dividends (equity index) :