Page 27 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 27

LOS 39.a: Describe and compare how equity, interest

rate, fixed-income, and currency forward and futures READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

contracts are priced and valued.

LOS 39.b: Calculate and interpret the no-arbitrage

value of equity, interest rate, fixed-income, and MODULE 39.3: PRICING AND VALUATION OF FIXED INCOME FORWARDS

currency forward and futures contracts.

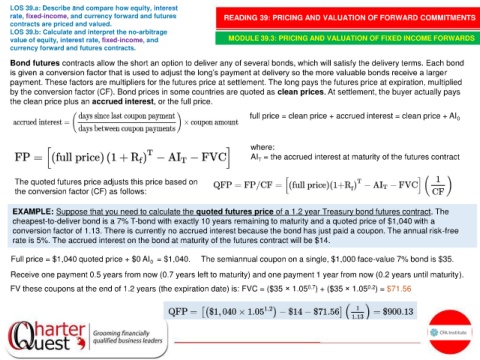

Bond futures contracts allow the short an option to deliver any of several bonds, which will satisfy the delivery terms. Each bond

is given a conversion factor that is used to adjust the long’s payment at delivery so the more valuable bonds receive a larger

payment. These factors are multipliers for the futures price at settlement. The long pays the futures price at expiration, multiplied

by the conversion factor (CF). Bond prices in some countries are quoted as clean prices. At settlement, the buyer actually pays

the clean price plus an accrued interest, or the full price.

full price = clean price + accrued interest = clean price + AI 0

where:

AI = the accrued interest at maturity of the futures contract

T

The quoted futures price adjusts this price based on

the conversion factor (CF) as follows:

EXAMPLE: Suppose that you need to calculate the quoted futures price of a 1.2 year Treasury bond futures contract. The

cheapest-to-deliver bond is a 7% T-bond with exactly 10 years remaining to maturity and a quoted price of $1,040 with a

conversion factor of 1.13. There is currently no accrued interest because the bond has just paid a coupon. The annual risk-free

rate is 5%. The accrued interest on the bond at maturity of the futures contract will be $14.

Full price = $1,040 quoted price + $0 AI = $1,040. The semiannual coupon on a single, $1,000 face-value 7% bond is $35.

0

Receive one payment 0.5 years from now (0.7 years left to maturity) and one payment 1 year from now (0.2 years until maturity).

0.2

0.7

FV these coupons at the end of 1.2 years (the expiration date) is: FVC = ($35 × 1.05 ) + ($35 × 1.05 ) = $71.56