Page 29 - FINAL CFA II SLIDES JUNE 2019 DAY 10

P. 29

LOS 39.a: Describe and compare how equity, interest rate,

fixed-income, and currency forward and futures contracts are READING 39: PRICING AND VALUATION OF FORWARD COMMITMENTS

priced and valued.

LOS 39.b: Calculate and interpret the no-arbitrage value of

equity, interest rate, fixed-income, and currency forward and MODULE 39.4: PRICING FORWARD RATE AGREEMENTS

futures contracts.

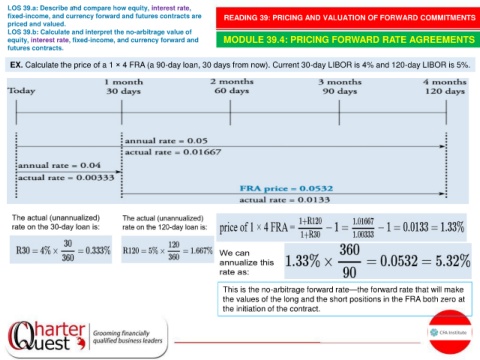

EX. Calculate the price of a 1 × 4 FRA (a 90-day loan, 30 days from now). Current 30-day LIBOR is 4% and 120-day LIBOR is 5%.

This is the no-arbitrage forward rate—the forward rate that will make

the values of the long and the short positions in the FRA both zero at

the initiation of the contract.