Page 369 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 369

Answers

Chapter 7

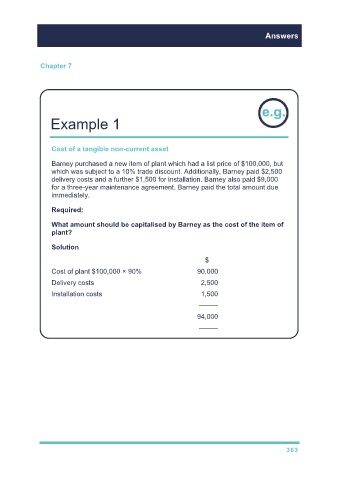

Example 1

Cost of a tangible non-current asset

Barney purchased a new item of plant which had a list price of $100,000, but

which was subject to a 10% trade discount. Additionally, Barney paid $2,500

delivery costs and a further $1,500 for installation. Barney also paid $9,000

for a three-year maintenance agreement. Barney paid the total amount due

immediately.

Required:

What amount should be capitalised by Barney as the cost of the item of

plant?

Solution

$

Cost of plant $100,000 × 90% 90,000

Delivery costs 2,500

Installation costs 1,500

–––––

94,000

–––––

363