Page 370 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 370

Chapter 24

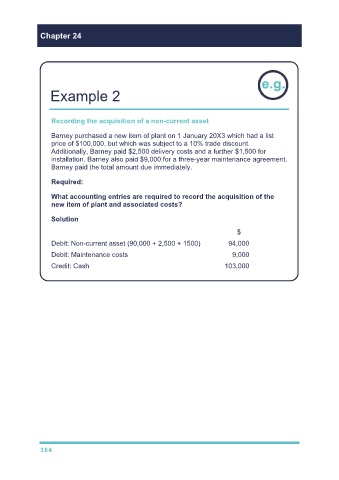

Example 2

Recording the acquisition of a non-current asset

Barney purchased a new item of plant on 1 January 20X3 which had a list

price of $100,000, but which was subject to a 10% trade discount.

Additionally, Barney paid $2,500 delivery costs and a further $1,500 for

installation. Barney also paid $9,000 for a three-year maintenance agreement.

Barney paid the total amount due immediately.

Required:

What accounting entries are required to record the acquisition of the

new item of plant and associated costs?

Solution

$

Debit: Non-current asset (90,000 + 2,500 + 1500) 94,000

Debit: Maintenance costs 9,000

Credit: Cash 103,000

364