Page 374 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 374

Chapter 24

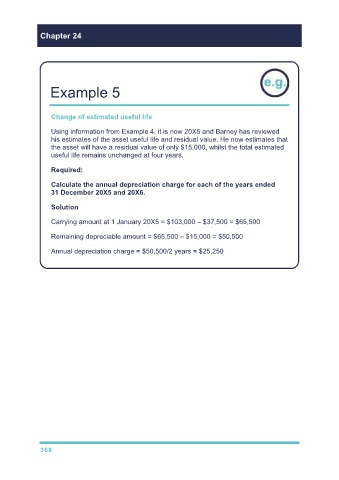

Example 5

Change of estimated useful life

Using information from Example 4, it is now 20X5 and Barney has reviewed

his estimates of the asset useful life and residual value. He now estimates that

the asset will have a residual value of only $15,000, whilst the total estimated

useful life remains unchanged at four years.

Required:

Calculate the annual depreciation charge for each of the years ended

31 December 20X5 and 20X6.

Solution

Carrying amount at 1 January 20X5 = $103,000 – $37,500 = $65,500

Remaining depreciable amount = $65,500 – $15,000 = $50,500

Annual depreciation charge = $50,500/2 years = $25,250

368