Page 304 - P1 Integrated Workbook STUDENT 2018

P. 304

Subject P1: Management Accounting

5.5 The answer is $25,000.

Point A represents a decision point. If the decision is taken to licence then there

is a value of $10k.

The other decision is to further invest – which appears to have a cost of $8k.

But this then opens up the chance point where there is an 80% chance of

making $40k and a 20% chance of making $5k. So this decision to further

invest would have an expected value of:

= -8k + [(0.80 × 40) + (0.20 × 5)] = $25k

Therefore, the decision to further invest is worth more than the licencing option.

The company would choose to further invest and would make $25k. This is the

value at point A

5.6 D

A regret table shows the shortfall from the maximum contribution that could be

earned at each demand level. For a demand level of 40 units the maximum

possible profit is $9,000. However, if only 20 units are produced then the return

will be only $7,500. This represents a potential shortfall of $1,500 at Point X.

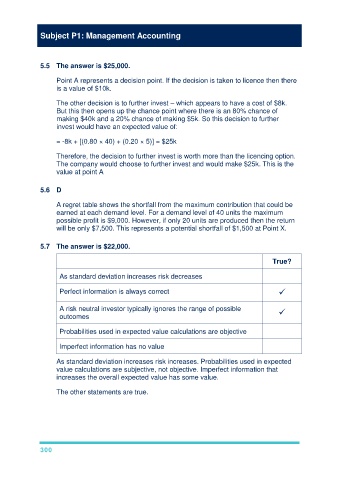

5.7 The answer is $22,000.

True?

As standard deviation increases risk decreases

Perfect information is always correct

A risk neutral investor typically ignores the range of possible

outcomes

Probabilities used in expected value calculations are objective

Imperfect information has no value

As standard deviation increases risk increases. Probabilities used in expected

value calculations are subjective, not objective. Imperfect information that

increases the overall expected value has some value.

The other statements are true.

300