Page 301 - P1 Integrated Workbook STUDENT 2018

P. 301

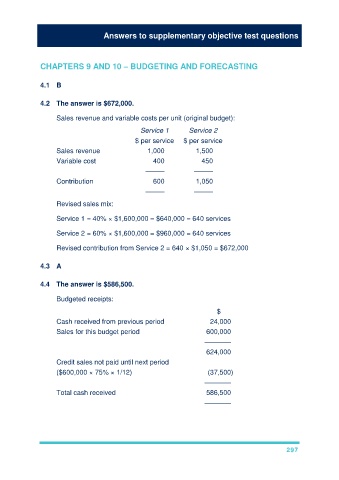

Answers to supplementary objective test questions

CHAPTERS 9 AND 10 – BUDGETING AND FORECASTING

4.1 B

4.2 The answer is $672,000.

Sales revenue and variable costs per unit (original budget):

Service 1 Service 2

$ per service $ per service

Sales revenue 1,000 1,500

Variable cost 400 450

––––– –––––

Contribution 600 1,050

––––– –––––

Revised sales mix:

Service 1 = 40% × $1,600,000 = $640,000 = 640 services

Service 2 = 60% × $1,600,000 = $960,000 = 640 services

Revised contribution from Service 2 = 640 × $1,050 = $672,000

4.3 A

4.4 The answer is $586,500.

Budgeted receipts:

$

Cash received from previous period 24,000

Sales for this budget period 600,000

–––––––

624,000

Credit sales not paid until next period

($600,000 × 75% × 1/12) (37,500)

–––––––

Total cash received 586,500

–––––––

297