Page 61 - PowerPoint Presentation

P. 61

LOS 36.q: Compare the risk–return characteristics of a

convertible bond with the risk–return characteristics of READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

a straight bond and of the underlying common stock.

MODULE 36.8: CONVERTIBLE BONDS

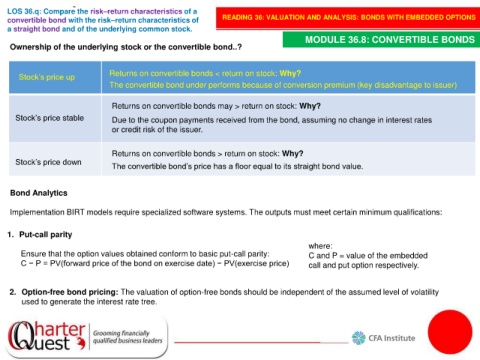

Ownership of the underlying stock or the convertible bond..?

Returns on convertible bonds < return on stock: Why?

Stock’s price up

The convertible bond under performs because of conversion premium (key disadvantage to issuer)

Returns on convertible bonds may > return on stock: Why?

Stock’s price stable Due to the coupon payments received from the bond, assuming no change in interest rates

or credit risk of the issuer.

Returns on convertible bonds > return on stock: Why?

Stock’s price down

The convertible bond’s price has a floor equal to its straight bond value.

Bond Analytics

Implementation BIRT models require specialized software systems. The outputs must meet certain minimum qualifications:

1. Put-call parity

where:

Ensure that the option values obtained conform to basic put-call parity: C and P = value of the embedded

C − P = PV(forward price of the bond on exercise date) − PV(exercise price) call and put option respectively.

2. Option-free bond pricing: The valuation of option-free bonds should be independent of the assumed level of volatility

used to generate the interest rate tree.