Page 60 - PowerPoint Presentation

P. 60

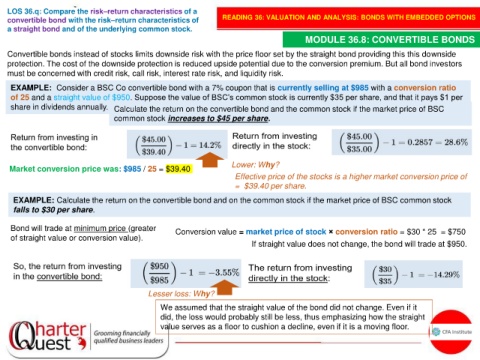

LOS 36.q: Compare the risk–return characteristics of a

convertible bond with the risk–return characteristics of READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

a straight bond and of the underlying common stock.

MODULE 36.8: CONVERTIBLE BONDS

Convertible bonds instead of stocks limits downside risk with the price floor set by the straight bond providing this this downside

protection. The cost of the downside protection is reduced upside potential due to the conversion premium. But all bond investors

must be concerned with credit risk, call risk, interest rate risk, and liquidity risk.

EXAMPLE: Consider a BSC Co convertible bond with a 7% coupon that is currently selling at $985 with a conversion ratio

of 25 and a straight value of $950. Suppose the value of BSC’s common stock is currently $35 per share, and that it pays $1 per

share in dividends annually. Calculate the return on the convertible bond and the common stock if the market price of BSC

common stock increases to $45 per share.

Lower: Why?

Market conversion price was: $985 / 25 = $39.40

Effective price of the stocks is a higher market conversion price of

= $39.40 per share.

EXAMPLE: Calculate the return on the convertible bond and on the common stock if the market price of BSC common stock

falls to $30 per share.

Bond will trade at minimum price (greater Conversion value = market price of stock × conversion ratio = $30 * 25 = $750

of straight value or conversion value).

If straight value does not change, the bond will trade at $950.

Lesser loss: Why?

We assumed that the straight value of the bond did not change. Even if it

did, the loss would probably still be less, thus emphasizing how the straight

value serves as a floor to cushion a decline, even if it is a moving floor.