Page 55 - PowerPoint Presentation

P. 55

LOS 36.m: Calculate the value of a capped or READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

floored floating-rate bond.

MODULE 36.6: KEY RATE DURATION

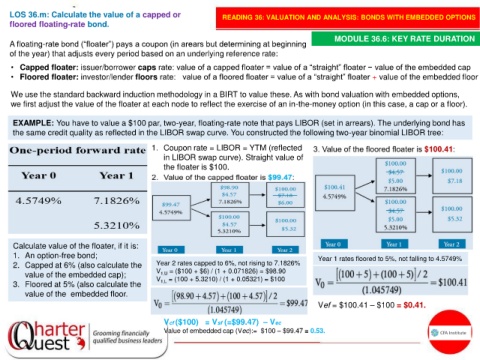

A floating-rate bond (“floater”) pays a coupon (in arears but determining at beginning

of the year) that adjusts every period based on an underlying reference rate:

• Capped floater: issuer/borrower caps rate: value of a capped floater = value of a “straight” floater − value of the embedded cap

• Floored floater: investor/lender floors rate: value of a floored floater = value of a “straight” floater + value of the embedded floor

We use the standard backward induction methodology in a BIRT to value these. As with bond valuation with embedded options,

we first adjust the value of the floater at each node to reflect the exercise of an in-the-money option (in this case, a cap or a floor).

EXAMPLE: You have to value a $100 par, two-year, floating-rate note that pays LIBOR (set in arrears). The underlying bond has

the same credit quality as reflected in the LIBOR swap curve. You constructed the following two-year binomial LIBOR tree:

1. Coupon rate = LIBOR = YTM (reflected

in LIBOR swap curve). Straight value of

the floater is $100.

Calculate value of the floater, if it is:

1. An option-free bond; Year 1 rates floored to 5%, not falling to 4.5749%

2. Capped at 6% (also calculate the Year 2 rates capped to 6%, not rising to 7.1826%

= ($100 + $6) / (1 + 0.071826) = $98.90

value of the embedded cap); V 1,U = (100 + 5.3210) / (1 + 0.05321) = $100

V

3. Floored at 5% (also calculate the 1,L

value of the embedded floor.

Vef = $100.41 – $100 = $0.41.

Vcf ($100) = Vsf (=$99.47) – Vec

Value of embedded cap (Vec):= $100 – $99.47 = 0.53.