Page 58 - PowerPoint Presentation

P. 58

LOS 36.o: Calculate and interpret the READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

components of a convertible bond’s value

MODULE 36.8: CONVERTIBLE BONDS

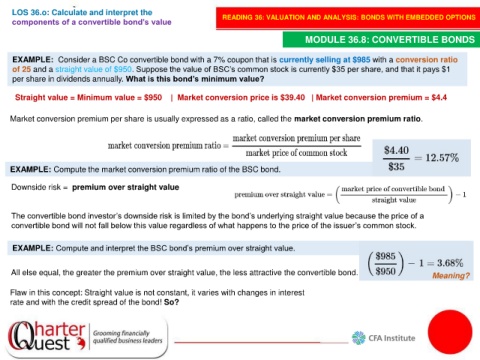

EXAMPLE: Consider a BSC Co convertible bond with a 7% coupon that is currently selling at $985 with a conversion ratio

of 25 and a straight value of $950. Suppose the value of BSC’s common stock is currently $35 per share, and that it pays $1

per share in dividends annually. What is this bond’s minimum value?

Straight value = Minimum value = $950 | Market conversion price is $39.40 | Market conversion premium = $4.4

Market conversion premium per share is usually expressed as a ratio, called the market conversion premium ratio.

EXAMPLE: Compute the market conversion premium ratio of the BSC bond.

Downside risk = premium over straight value

The convertible bond investor’s downside risk is limited by the bond’s underlying straight value because the price of a

convertible bond will not fall below this value regardless of what happens to the price of the issuer’s common stock.

EXAMPLE: Compute and interpret the BSC bond’s premium over straight value.

All else equal, the greater the premium over straight value, the less attractive the convertible bond. Meaning?

Flaw in this concept: Straight value is not constant, it varies with changes in interest

rate and with the credit spread of the bond! So?