Page 56 - PowerPoint Presentation

P. 56

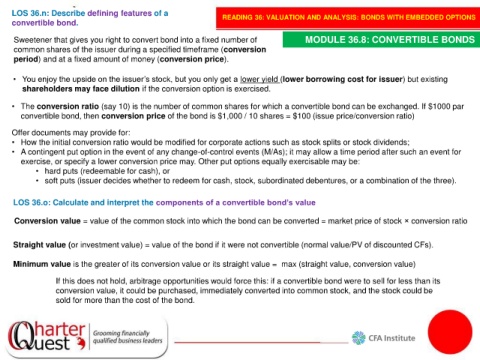

LOS 36.n: Describe defining features of a READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

convertible bond.

Sweetener that gives you right to convert bond into a fixed number of MODULE 36.8: CONVERTIBLE BONDS

common shares of the issuer during a specified timeframe (conversion

period) and at a fixed amount of money (conversion price).

• You enjoy the upside on the issuer’s stock, but you only get a lower yield (lower borrowing cost for issuer) but existing

shareholders may face dilution if the conversion option is exercised.

• The conversion ratio (say 10) is the number of common shares for which a convertible bond can be exchanged. If $1000 par

convertible bond, then conversion price of the bond is $1,000 / 10 shares = $100 (issue price/conversion ratio)

Offer documents may provide for:

• How the initial conversion ratio would be modified for corporate actions such as stock splits or stock dividends;

• A contingent put option in the event of any change-of-control events (M/As); it may allow a time period after such an event for

exercise, or specify a lower conversion price may. Other put options equally exercisable may be:

• hard puts (redeemable for cash), or

• soft puts (issuer decides whether to redeem for cash, stock, subordinated debentures, or a combination of the three).

LOS 36.o: Calculate and interpret the components of a convertible bond’s value

Conversion value = value of the common stock into which the bond can be converted = market price of stock × conversion ratio

Straight value (or investment value) = value of the bond if it were not convertible (normal value/PV of discounted CFs).

Minimum value is the greater of its conversion value or its straight value = max (straight value, conversion value)

If this does not hold, arbitrage opportunities would force this: if a convertible bond were to sell for less than its

conversion value, it could be purchased, immediately converted into common stock, and the stock could be

sold for more than the cost of the bond.