Page 57 - PowerPoint Presentation

P. 57

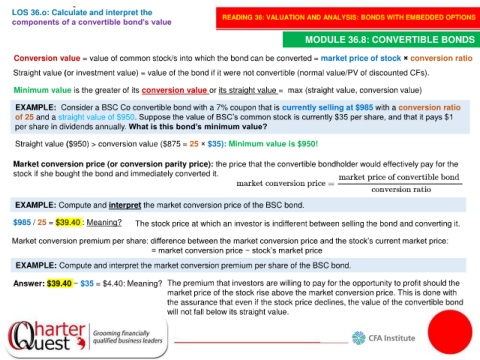

LOS 36.o: Calculate and interpret the READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

components of a convertible bond’s value

MODULE 36.8: CONVERTIBLE BONDS

Conversion value = value of common stock/s into which the bond can be converted = market price of stock × conversion ratio

Straight value (or investment value) = value of the bond if it were not convertible (normal value/PV of discounted CFs).

Minimum value is the greater of its conversion value or its straight value = max (straight value, conversion value)

EXAMPLE: Consider a BSC Co convertible bond with a 7% coupon that is currently selling at $985 with a conversion ratio

of 25 and a straight value of $950. Suppose the value of BSC’s common stock is currently $35 per share, and that it pays $1

per share in dividends annually. What is this bond’s minimum value?

Straight value ($950) > conversion value ($875 = 25 × $35): Minimum value is $950!

Market conversion price (or conversion parity price): the price that the convertible bondholder would effectively pay for the

stock if she bought the bond and immediately converted it.

EXAMPLE: Compute and interpret the market conversion price of the BSC bond.

$985 / 25 = $39.40 : Meaning? The stock price at which an investor is indifferent between selling the bond and converting it.

Market conversion premium per share: difference between the market conversion price and the stock’s current market price:

= market conversion price − stock’s market price

EXAMPLE: Compute and interpret the market conversion premium per share of the BSC bond.

Answer: $39.40 − $35 = $4.40: Meaning? The premium that investors are willing to pay for the opportunity to profit should the

market price of the stock rise above the market conversion price. This is done with

the assurance that even if the stock price declines, the value of the convertible bond

will not fall below its straight value.