Page 51 - PowerPoint Presentation

P. 51

LOS 36.j: Compare effective durations of READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

callable, putable, and straight bonds.

Both call and put options have the potential to reduce the life of a bond, so the MODULE 36.5: DURATION

duration of callable and putable bonds will be less than or equal to the duration of

their straight counterparts.

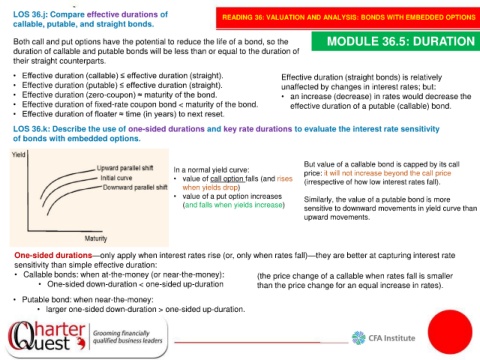

• Effective duration (callable) ≤ effective duration (straight). Effective duration (straight bonds) is relatively

• Effective duration (putable) ≤ effective duration (straight). unaffected by changes in interest rates; but:

• Effective duration (zero-coupon) ≈ maturity of the bond. • an increase (decrease) in rates would decrease the

• Effective duration of fixed-rate coupon bond < maturity of the bond. effective duration of a putable (callable) bond.

• Effective duration of floater ≈ time (in years) to next reset.

LOS 36.k: Describe the use of one-sided durations and key rate durations to evaluate the interest rate sensitivity

of bonds with embedded options.

But value of a callable bond is capped by its call

In a normal yield curve: price: it will not increase beyond the call price

• value of call option falls (and rises (irrespective of how low interest rates fall).

when yields drop)

• value of a put option increases Similarly, the value of a putable bond is more

(and falls when yields increase) sensitive to downward movements in yield curve than

upward movements.

One-sided durations—only apply when interest rates rise (or, only when rates fall)—they are better at capturing interest rate

sensitivity than simple effective duration:

• Callable bonds: when at-the-money (or near-the-money): (the price change of a callable when rates fall is smaller

• One-sided down-duration < one-sided up-duration than the price change for an equal increase in rates).

• Putable bond: when near-the-money:

• larger one-sided down-duration > one-sided up-duration.