Page 63 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 63

Session Unit 2:

LOS 8.k: Describe the relative locations of the mean, median,

and mode for a unimodal, non-symmetrical distribution. 8. Statistical Concepts and Market Returns (B)

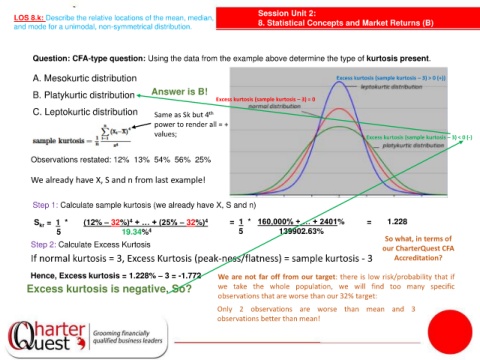

Question: CFA-type question: Using the data from the example above determine the type of kurtosis present.

A. Mesokurtic distribution Excess kurtosis (sample kurtosis – 3) > 0 (+))

B. Platykurtic distribution Answer is B!

Excess kurtosis (sample kurtosis – 3) = 0

C. Leptokurtic distribution Same as Sk but 4 th

power to render all = +

values;

Excess kurtosis (sample kurtosis – 3) < 0 (-)

Observations restated: 12% 13% 54% 56% 25%

We already have X, S and n from last example!

Step 1: Calculate sample kurtosis (we already have X, S and n)

4

S = 1 * (12% – 32%) + … + (25% – 32%) 4 = 1 * 160,000% + … + 2401% = 1.228

kr

5 19.34% 4 5 139902.63%

So what, in terms of

Step 2: Calculate Excess Kurtosis

our CharterQuest CFA

If normal kurtosis = 3, Excess Kurtosis (peak-ness/flatness) = sample kurtosis - 3 Accreditation?

Hence, Excess kurtosis = 1.228% – 3 = -1.772 We are not far off from our target: there is low risk/probability that if

Excess kurtosis is negative, So? we take the whole population, we will find too many specific

observations that are worse than our 32% target:

Only 2 observations are worse than mean and 3

observations better than mean!