Page 60 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 60

Session Unit 2:

LOS 8.l: Explain measures of sample 8. Statistical Concepts and Market Returns (B)

skewness and kurtosis, p.154

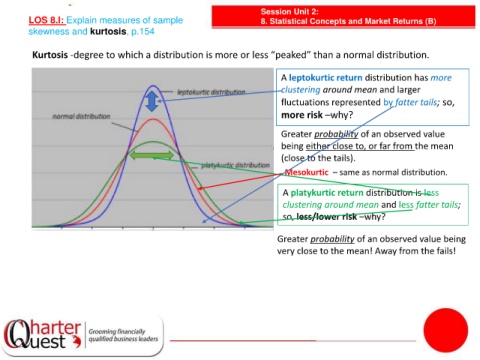

Kurtosis -degree to which a distribution is more or less “peaked” than a normal distribution.

A leptokurtic return distribution has more

clustering around mean and larger

fluctuations represented by fatter tails; so,

more risk –why?

Greater probability of an observed value

being either close to, or far from the mean

(close to the tails).

Mesokurtic – same as normal distribution.

A platykurtic return distribution is less

clustering around mean and less fatter tails;

so, less/lower risk –why?

Greater probability of an observed value being

very close to the mean! Away from the fails!