Page 62 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 62

Session Unit 2:

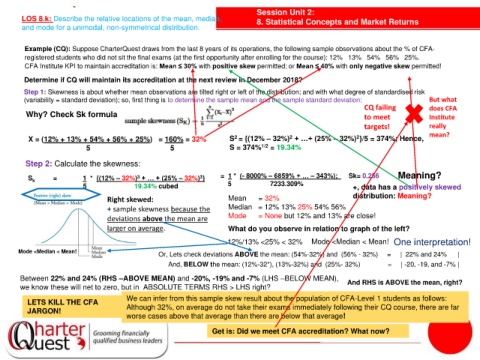

LOS 8.k: Describe the relative locations of the mean, median, 8. Statistical Concepts and Market Returns

and mode for a unimodal, non-symmetrical distribution.

Example (CQ): Suppose CharterQuest draws from the last 8 years of its operations, the following sample observations about the % of CFA-

registered students who did not sit the final exams (at the first opportunity after enrolling for the course): 12% 13% 54% 56% 25%.

CFA Institute KPI to maintain accreditation is: Mean ≤ 30% with positive skew permitted; or Mean ≤ 40% with only negative skew permitted!

Determine if CQ will maintain its accreditation at the next review in December 2018?

Step 1: Skewness is about whether mean observations are tilted right or left of the distribution; and with what degree of standardised risk

(variability = standard deviation); so, first thing is to determine the sample mean and the sample standard deviation: But what

CQ failing does CFA

Why? Check Sk formula to meet Institute

targets! really

mean?

2

2

2

X = (12% + 13% + 54% + 56% + 25%) = 160% = 32% S = {(12% – 32%) + …+ (25% – 32%) }/5 = 374%; Hence,

5 5 S = 374% 1/2 = 19.34%

Step 2: Calculate the skewness:

S k = 1 * {(12% – 32%) + … + (25% – 32%) } = 1 * (- 8000% – 6859% + … – 343%); Sk= 0.256 Meaning?

3

3

5 7233.309%

5 19.34% cubed +, data has a positively skewed

Right skewed: Mean = 32% distribution: Meaning?

+ sample skewness because the Median = 12% 13% 25% 54% 56%

deviations above the mean are Mode = None but 12% and 13% are close!

larger on average. What do you observe in relation to graph of the left?

12%/13% <25% < 32% Mode <Median < Mean! One interpretation!

Mode <Median < Mean!

Or, Lets check deviations ABOVE the mean: (54%-32%) and (56% - 32%) = | 22% and 24% |

And, BELOW the mean: (12%-32*), (13%-32%) and (25%- 32%) = | -20, -19, and -7% |

Between 22% and 24% (RHS –ABOVE MEAN) and -20%, -19% and -7% (LHS –BELOW MEAN), And RHS is ABOVE the mean, right?

we know these will net to zero, but in ABSOLUTE TERMS RHS > LHS right?

We can infer from this sample skew result about the population of CFA-Level 1 students as follows:

LETS KILL THE CFA

JARGON! Although 32%, on average do not take their exams immediately following their CQ course, there are far

worse cases above that average than there are below that average!

Get is: Did we meet CFA accreditation? What now?