Page 64 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 64

Session Unit 2:

LOS 8.m: Compare the use of AM and GMs 8. Statistical Concepts and Market Returns (A/B)

when analyzing investment returns, p.155/156

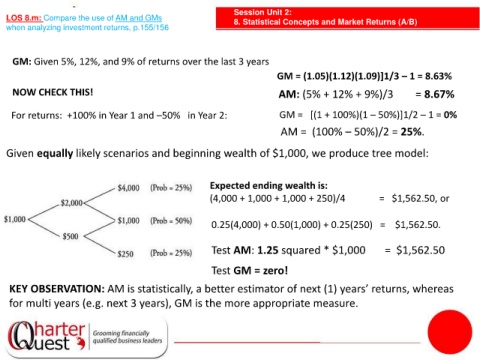

GM: Given 5%, 12%, and 9% of returns over the last 3 years

GM = (1.05)(1.12)(1.09)]1/3 – 1 = 8.63%

NOW CHECK THIS! AM: (5% + 12% + 9%)/3 = 8.67%

For returns: +100% in Year 1 and –50% in Year 2: GM = [(1 + 100%)(1 – 50%)]1/2 – 1 = 0%

AM = (100% – 50%)/2 = 25%.

Given equally likely scenarios and beginning wealth of $1,000, we produce tree model:

Expected ending wealth is:

(4,000 + 1,000 + 1,000 + 250)/4 = $1,562.50, or

0.25(4,000) + 0.50(1,000) + 0.25(250) = $1,562.50.

Test AM: 1.25 squared * $1,000 = $1,562.50

Test GM = zero!

KEY OBSERVATION: AM is statistically, a better estimator of next (1) years’ returns, whereas

for multi years (e.g. next 3 years), GM is the more appropriate measure.