Page 13 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 13

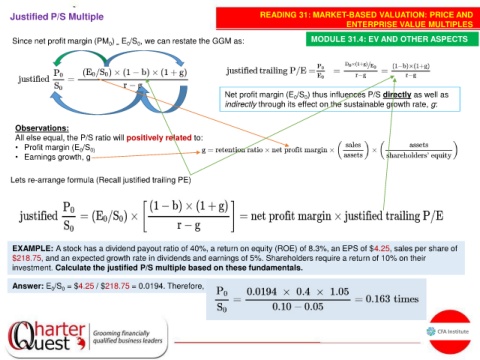

Justified P/S Multiple READING 31: MARKET-BASED VALUATION: PRICE AND

ENTERPRISE VALUE MULTIPLES

Since net profit margin (PM ) E /S , we can restate the GGM as: MODULE 31.4: EV AND OTHER ASPECTS

0

0

0 =

Net profit margin (E /S ) thus influences P/S directly as well as

0

0

indirectly through its effect on the sustainable growth rate, g:

Observations:

All else equal, the P/S ratio will positively related to:

• Profit margin (E /S 0)

0

• Earnings growth, g

Lets re-arrange formula (Recall justified trailing PE)

EXAMPLE: A stock has a dividend payout ratio of 40%, a return on equity (ROE) of 8.3%, an EPS of $4.25, sales per share of

$218.75, and an expected growth rate in dividends and earnings of 5%. Shareholders require a return of 10% on their

investment. Calculate the justified P/S multiple based on these fundamentals.

Answer: E /S = $4.25 / $218.75 = 0.0194. Therefore,

0

0